Since my last analysis, spot gold and GLD indeed sold off down to US$1,450 and US$136.12. However, thanks to worldwide “whatever it takes” measurements by central bankers and governments spot gold prices quickly came back roaring up to US$1,747 just last week. Even though this unprecedented money expansion will spark inflation and probably even hyperinflation down the road, my initial short-term skepticism has even increased over the last few days. I think gold is more likely to start a correction or consolidation for the next few months instead of running directly higher towards its all-time high.

Review

Since the last important low at US$1,160 on August 16th, 2018, spot gold was able to rise up to US$1,747 within just under 20 months. From the low point at that time to the recent high point on April 14th, 2020, gold was thus able to gain US$587 or 50.6%. In theory, this corresponds to a breathtaking annual return of over 30% p.a. In the long term, however, the price of gold “only” rises by an average of around 7-9% per year. The last one and a half years have thus seen an exceptionally strong gold price.

Over the last 20 months, only relatively few price pullbacks have been observed overall. In most cases, the need for correction was primarily worked off over the time axis in the form of prolonged consolidations. Only since the end of February, the gold market is facing much sharper pullbacks and much higher volatility. The high of February 24th at US$1,689 was followed by a sharp pullback of US$126 down to US$1,563. Starting from the next high on March 9th at US$1,703, the corona panic led to an even more severe pullback of US$252 down to US$1,451. Since this sell-off, however, the gold price has again risen sharply and reached a new high of US$1,747 last Tuesday.

Since end of February gold faced a brutal rollercoaster

Towards the end of last week however, prices on the spot market have already fallen back again by US$75 and closed the trading week at US$1,672, well below the psychological mark of US$1,700. All in all, the gold price has thus been going through a brutal rollercoaster ride for almost two months now. Investors who have invested in physical gold early on can easily ride out the current price caprices and are even enjoying the exploding premiums on their physical holdings.

Those who have not yet invested have little chances of making a reasonable entry into the precious metals in this environment. Nevertheless, regardless of price, every investor should hold at least a minimum of 5% of his assets in precious metals as insurance. On the other hand, anyone speculating on the gold price with leverage and paper products during this overheated cycle is playing with fire and, especially on the long side, is now taking incalculable risks. In any case, the sharp rise in volatility does not inspire confidence, but should rather be seen as a clear warning signal.

Technical Analysis: Gold in US Dollars

Gold in US Dollars

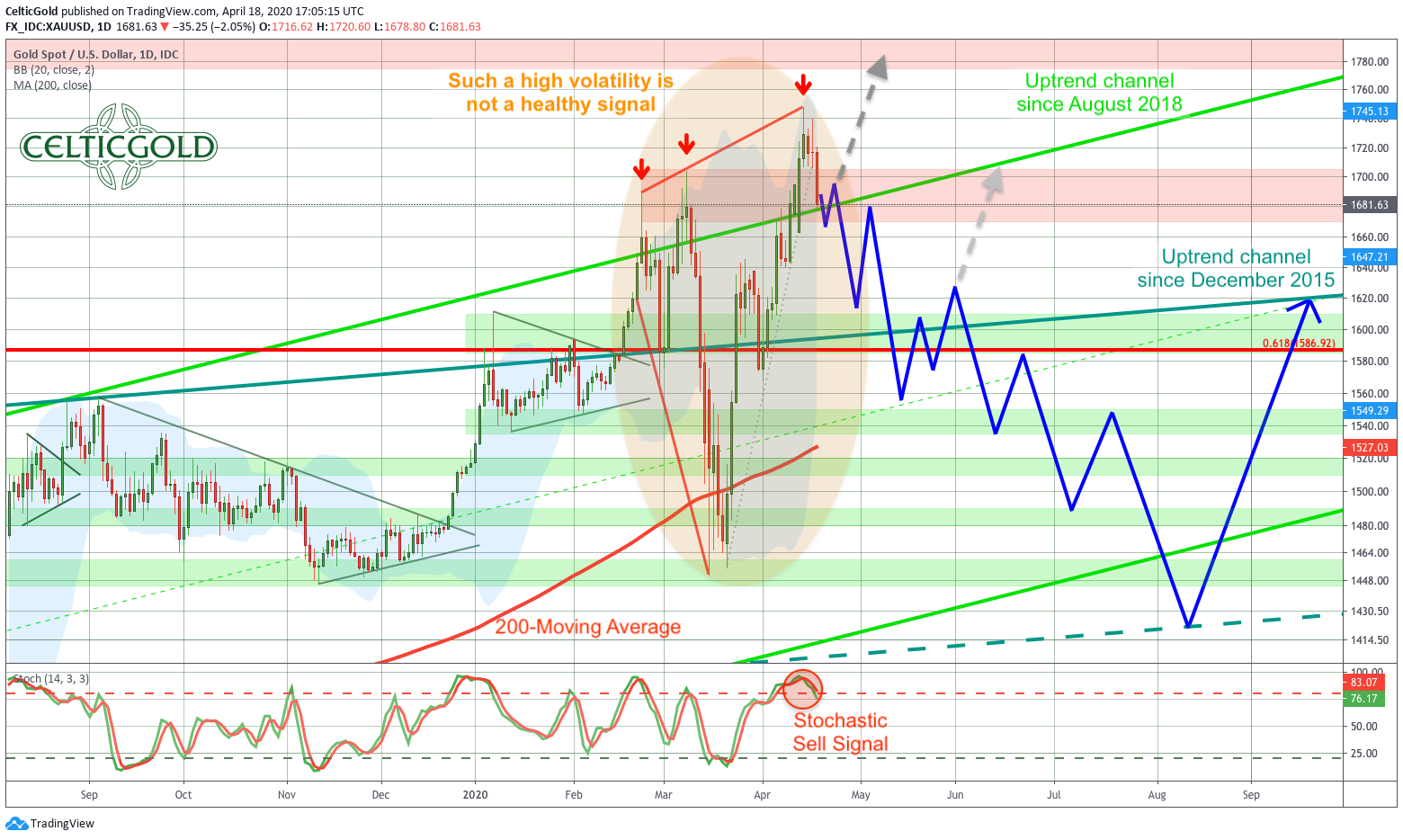

Gold in US-Dollar, weekly chart as of April 19th, 2020. Source: Tradingview

On the weekly chart there are two uptrend channels that support gold prices. The first one, in dark green, has been moving up relatively flat since December 2015. In September 2019, gold tested its upper edge for the first time since summer 2016. Since the beginning of the year, the gold market has been struggling at this upper edge, which has recently led to these highly volatile swings. Despite the temporary pullback in the meantime, the bulls have been able to break out of this channel in recent weeks, so that gold is currently trading clearly above the upper edge (currently approx. US$1,590 – 1,595) of the uptrend channel.

The second uptrend channel started with the last panic low at US$1,160 in August 2018. This trend channel is much steeper and has led a strong uptrend in its path over the last 20 months. Here as well, the bulls have been attacking the upper edge of the trend channel for a couple of weeks now. However, apart from several price spikes, they have so far failed to achieve sustainable weekly closing prices above the channel boundary.

First signals of a trend reversal

On Friday, the weekly candle closed with a potentially bearish “shooting star”. The opening and closing prices of the trading week are well below the high. Combined with the upper edge of the uptrend channel as resistance, as well as the obvious stochastic divergences, the gold market may now really have reached its high for this spring.

All in all, however, it is still too early to call a clear top in the gold market for the coming months. However, the probability of a trend reversal has increased significantly with the past trading week. Actually, it is quite possible that the impulsive uptrend has already come to an end at US$1,703 and that thanks to Corona we have been in an ABC correction pattern for over four weeks already. Wave A would have come to an end at US$1,451. The irregular wave B, with a slightly higher high at US$1,747, would have confused and misled all market participants once again. Subsequently, the end of wave C would now be expected with prices below wave A, that is, below US$1,451. The longstanding former resistance zone and current support of US$1,350 – 1,400 would be predestined as the price target for wave C.

From a fundamental point of view, however, this strong correction scenario in the gold market would require either strongly bullish stock markets or a deflationary collapse of the entire financial market. Driven by the enormous expansion of the money supply, a strong recovery in the stock-market, detached from the real economy, seems possible. On the other hand, central bankers will prevent a deflationary total collapse of the financial markets with their printing presses.

Gold in US-Dollar Daily Chart

Gold in US-Dollar, daily chart as of April 19th, 2020. Source: Tradingview

A very unhealthy structure has established itself on the daily chart due to the wild swings in prices over the past eight weeks. The originally clear uptrend was destroyed by the sharp pullback in March. While gold was just about to price in the catastrophic consequences of the global lockdown with a brutal sell-off, central bankers worldwide opened all monetary floodgates and flooded the markets. Gold could not help but react to this with a massive spike over the last few weeks. However, a clear technical picture has thus disappeared.

How sustainable the steep up-trending wave of the last few weeks really is, remains to be seen. In view of the heavily overbought situation and the recent sharp drop in trading volumes, a big question mark is more than justified.

In summary, the daily chart is overbought. The stochastic has delivered a fresh sell signal. If the upper edge of the light green upward-trend channel does not hold, the bears should be able to quickly penetrate the next support zone around approx. US$1,620 – 1,640. However, if a significant recovery above US$1,720 is accomplished in the current trading week, the uptrend could still continue towards US$1,800.

The commitment of Traders

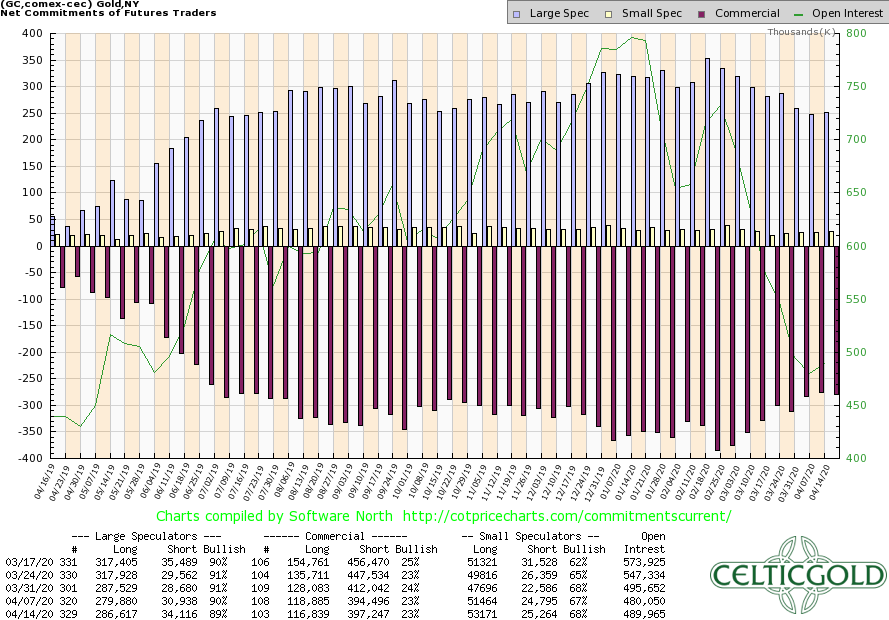

Gold COT Report

The commitment of Traders for Gold as of April 14th, 2020. Source: CoT Price Charts

Since the breakout above the multi-year resistance zone 1,350/1,375 USD in May 2019, the situation in the futures market has been extremely overstretched and completely unhealthy. Only in the last few weeks a first tentative improvement has become apparent as the commercial short position has fallen to the current level of 280,408 short contracts. However, a contrarian bottleneck is still a long way off. This would be the case at the earliest with a cumulated commercial short position below 100,000 short contracts.

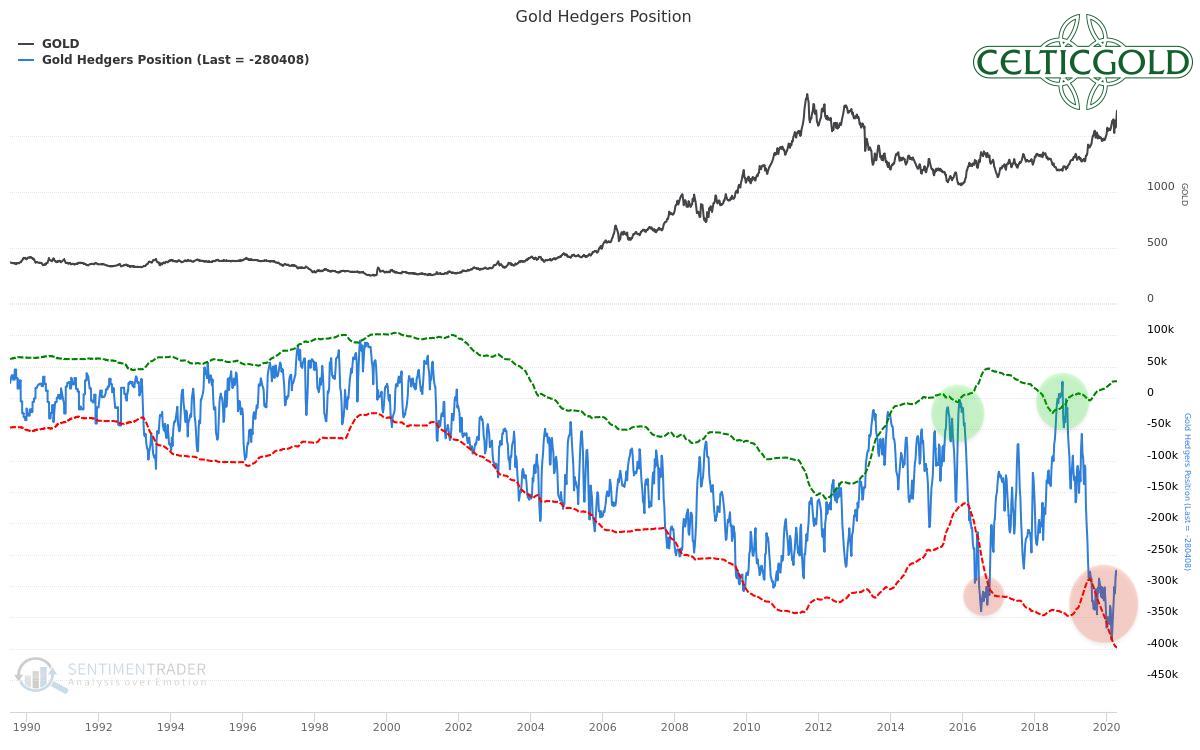

Gold Hedgers Position

Commitment of Traders for Gold as of April 19th, 2020. Source: Sentimentrader

Overall, the clear sell-signal of the CoT-report continues to be valid. However, with the strongly increased volatility in the last weeks, the adjustment of the futures market seems to have begun. In extreme cases, a price decline to at least US$1,350/1,400 is needed here so that the professionals can gradually cover their short bets and hedges into the falling prices. In the case of silver, the temporary sharp fall in prices down to US$11.60 has already cleaned up the future market.

Sentiment

Sentiment Optix For Gold

Sentiment Optix for Gold as of April 19th, 2020. Source: Sentimentrader

Since the beginning of the year, the Optix sentiment barometer for the gold price has been delivering significantly increased levels of optimism. In particular, inexperienced small investors have been driven into the gold market en masse in recent weeks due to the corona panic. The professionals, on the other hand, have been increasingly cautious as of late. Sentiment has not yet been tilted, but not much is missing. However, the road to the other extreme, a panic mood similar to that of August 2018, would be very long and painful.

The Gold Optix is again giving a sell signal, as optimism is currently way too high. Only when at least the beginnings of panic and fear spread among gold investors will there be meaningful and contrarian opportunity again.

Seasonality

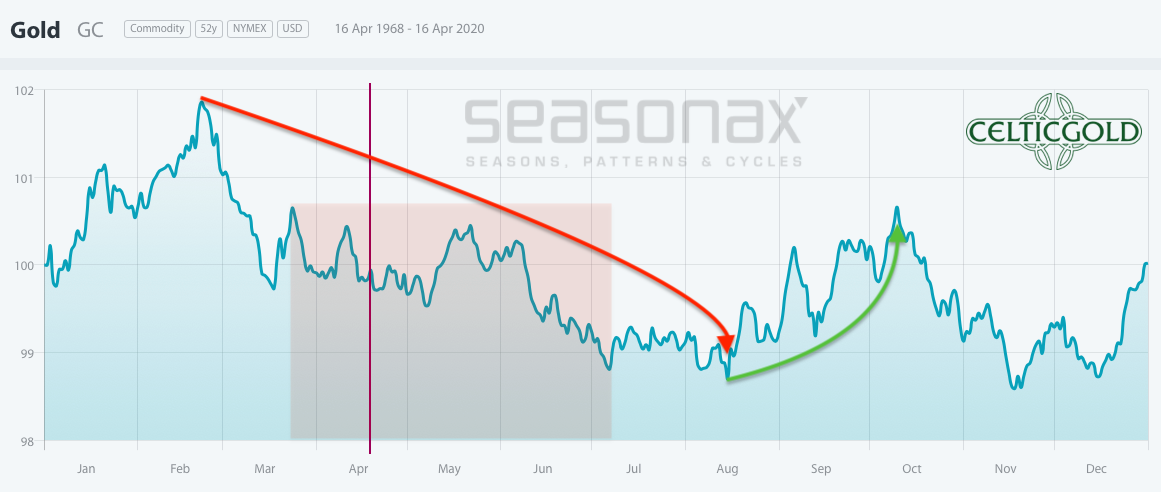

Seasonality for Gold

Seasonality for Gold as of April 19th, 2020. Source: Seasonax

On the statistical basis of the last 50 years, the gold price is now in its most unfavorable seasonal phase of the year. Similar to the well-known “sell in may and go away” rule, significant corrective movements in the gold market usually begin in spring and can extend into the mid of summer. In most years, the gold price reaches an important high point in February at the earliest and May at the latest. This is usually followed by a correction, which does not end until June at the earliest and August or September at the latest.

So far, gold topped on April 14th

This year and so far the highest point was reached only recently on the 14th of April. Obviously, this high point has not yet been definitively confirmed. If the presumed corrective movement begins now or in the coming weeks, it will not end before August/September. Until then, one should rather exercise patience. Although there can always be major interim rallies, in view of the sharp rises and the overbought situation on the daily, weekly and monthly charts, one should plan for at least three to four corrective months.

Meanwhile, the seasonality provides a clear sell-signal. However, this component of analysis should always be viewed in a more abstract manner. Moreover, there is no clearly confirmed high point in the current trading year so far. Only when this has become more visible, a possible time window for the next low can be defined.

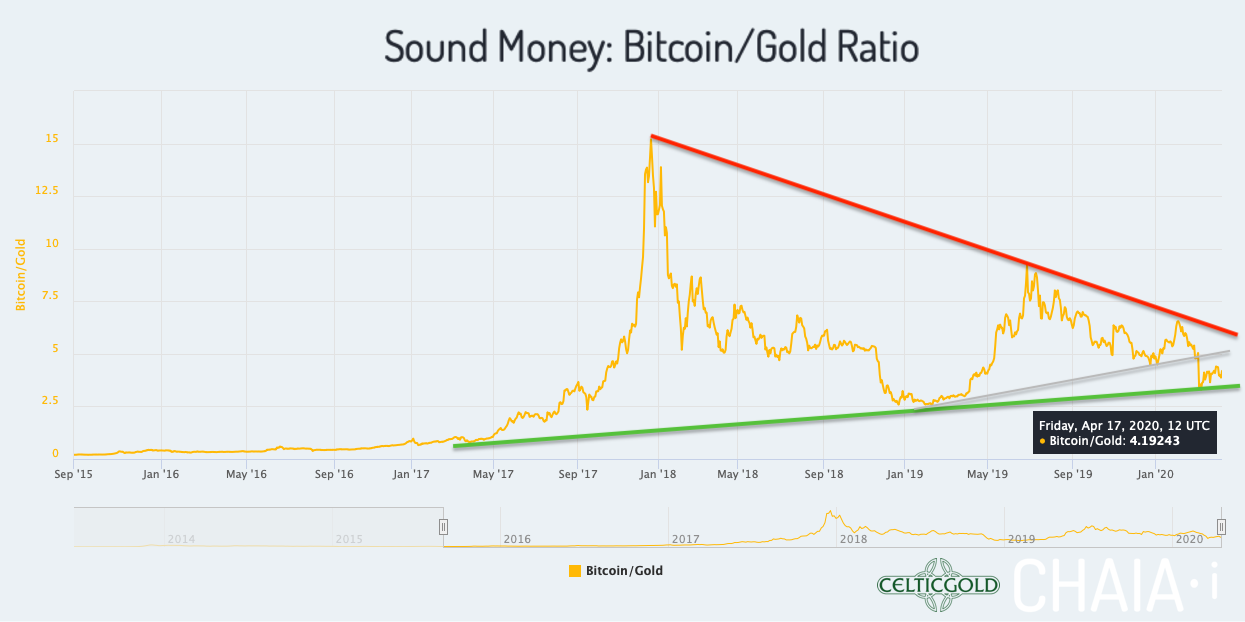

Bitcoin/Gold-Ratio

Bitcoin/Gold-Ratio

Sound Money Bitcoin/Gold-Ratio as of April 19th, 2020. Source: Chaia

Currently, you have to pay 4.2 ounces of gold for one Bitcoin. In other words, a troy ounce of gold currently costs only 0.22 Bitcoin. While the Bitcoin/Gold-ratio at the beginning of February still looked like a breakout in favor of Bitcoin, the emerging Corona crisis caused a clear shift towards gold. The Bitcoin/Gold-ratio fell well below a first important support line and has been struggling to recover since then.

Bitcoin/Gold-Ratio within a large triangle formation

Currently, the ratio is testing the lower edge of the two-and-a-half-year triangle formation. If this extremely important support is breached downwards, gold prices will subsequently outperform Bitcoin dramatically. If, on the other hand, the uptrend line can be defended, Bitcoin would then have the chance to break above the downtrend line which has been intact since December 2017. In this case, Bitcoin would continue its triumphal march. Overall, the ratio has already run relatively far into the apex of the triangle. A decision is expected within the next one to four months.

Generally, buying and selling Bitcoin against gold only makes sense to the extent that one balances the allocation in the two asset classes! At least 10% and a maximum of 25% of one’s total assets should be invested in precious metals physically, while in cryptos and especially in Bitcoin one should hold at least 1% and a maximum of 5%. If you are very familiar with cryptocurrencies and Bitcoin, you can certainly allocate higher percentages to Bitcoin on an individual basis. For the average investor, who is normally also invested in equities and real estate, 5% in the highly speculative and highly volatile Bitcoin is already a lot!

Conclusion for Gold

In the coming weeks a first at least rudimentary normalization after “Corona” is expected. The easing rally in the stock market in the so-called “risk on” mode could initially continue. These “Risk-On” phases can currently occur practically out of nowhere or due to important news (e.g. Gilead Sciences (NASDAQ:GILD) Update on COVID-19) very suddenly and quickly. Investors in the standard markets, spoiled for years by rising stock prices, are already celebrating the return to normality! Although the DAX is still more than 3,000 points below its all-time high reached in February (13,817 points), NASDAQ has already made up most of the “corona losses”. Tech giants like Amazon (NASDAQ:AMZN) are already trading at new all-time highs. A “Melt-up”, in which the freshly printed money rushes onto the stock markets, is quite conceivable and in some cases already underway.

“Risk-On” phases can harm gold

During such phases Gold is not needed and will most likely come under considerable pressure. Such a phase could initially come as part of the gradual normalization process. Only afterwards, when the markets understand and begin to price in the full extent of the damage, including its consequences and the need for much larger rescue packages, should the price of gold be able to rise further towards its all-time high. In the medium and long term, the distortions of recent weeks are therefore extremely bullish for gold and especially for silver.

In the short term, the gold price has already begun to price in the enormous expansion of the money supply. The rise from US$1,451 to US$1,747 in just a few weeks reflects this. However, the inflationary effects are unlikely to materialize immediately in our everyday life. On the contrary, the speed of money circulation is currently extremely low due to the real economy being kicked down, which means that the overbought precious metal prices are now vulnerable to a correction. From a sentiment perspective, all panic buyers have bought their precious metals at peak prices in recent weeks. However, as soon as the mines and refineries are operating normally again, the current bottleneck in precious metal will presumably disappear relatively quickly. Increased premiums could, however, accompany us for quite some time.

US$1,800 still possible but trend reversal is getting more and more likely

Looking ahead over the coming days and weeks, a continuation of the gold rally up to my original price target of US$1,800 is still possible. However, the risk/reward-ratio is now extremely unfavorable at current levels. In addition, the first reversal signals are beginning to appear on both the daily and weekly charts.

In view of the completely ruined financial and economic system worldwide, you should still not give up one single physical ounce of silver or gold. This is your life insurance from now on. Nevertheless, we should be prepared for a major correction in the price of gold in the coming months. Given the many unknown variables, it is not possible to predict how severe this will ultimately be. A healthy relapse in the direction of US$1,350/1,400 would probably be the best thing for the gold price in the long term. Prices in the direction of USD$1,000 however are very unlikely at present. In the best case, gold is already turning around US$1,550. Gold – Trend reversal is getting more and more likely.